Picture a trading floor where computers make millions of calculations simultaneously, analyzing market patterns across dimensions classical systems can’t even perceive. This isn’t science fiction—it’s quantum trading, and it’s already transforming how we approach financial markets.

The Quantum Revolution in Finance

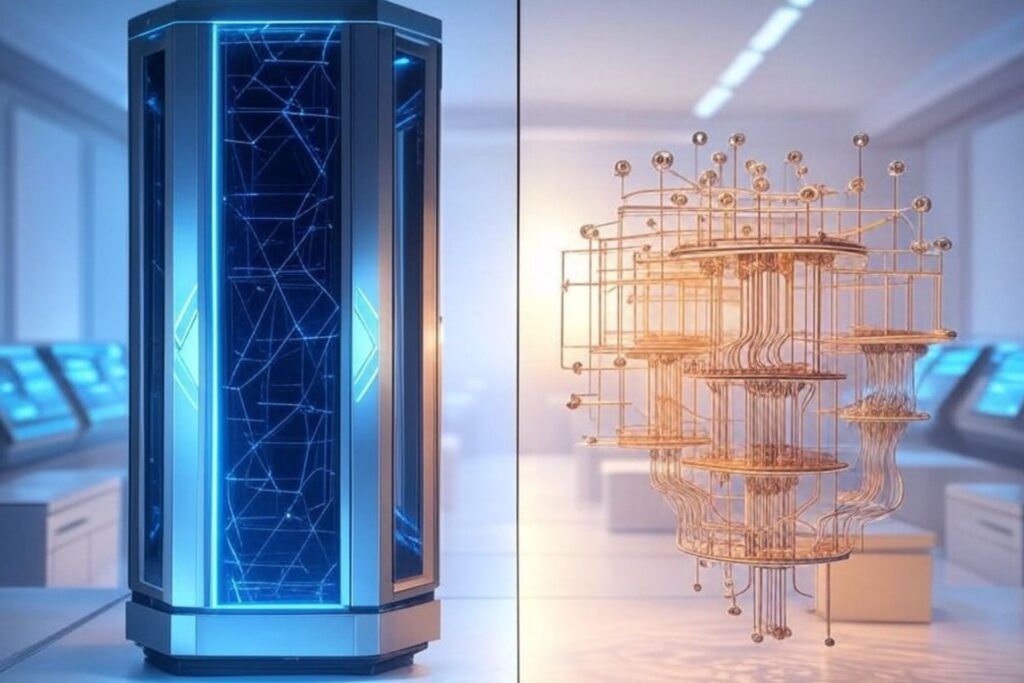

Quantum trading harnesses the extraordinary power of quantum computing to revolutionize financial market analysis and execution. Unlike traditional computers that process information linearly through bits, quantum systems utilize quantum bits (qubits) to perform complex calculations exponentially faster. This quantum advantage is reshaping critical financial operations, from portfolio optimization to high-frequency trading.

According to The Wall Street Journal’s June 2024 report, “The Age of Quantum Software Has Already Started”, major financial institutions aren’t just theorizing about quantum applications—they’re implementing them. IBM’s partnership with Wells Fargo exemplifies this shift, as they leverage quantum algorithms to enhance AI-driven trading strategies.

Breakthrough Applications Transforming Markets

High-Frequency Trading Evolution

Louna Labs’ September 2024 analysis reveals how quantum computing is revolutionizing high-frequency trading (HFT). These systems can now process vast market datasets in nanoseconds, identifying profitable patterns invisible to classical computers. The quantum advantage in speed and pattern recognition is creating new opportunities in microsecond-level trading decisions.

Advanced Portfolio Management

S&P Global’s October 2024 report highlights how quantum systems excel at solving complex portfolio optimization problems. These computers can simultaneously evaluate billions of potential asset combinations, leading to more refined investment strategies that better balance risk and return. The result? Portfolio configurations that classical computers might take years to discover.

Risk Assessment Revolution of Quantum trading

The Forbes Technology Council’s June 2024 analysis demonstrates how quantum computing is transforming risk management. Modern financial markets require processing massive amounts of data from diverse sources—economic indicators, geopolitical events, and market sentiment. Quantum algorithms excel at synthesizing these inputs into comprehensive risk assessments, enabling real-time strategy adjustments.

How does Quantum trading work?

Technical Infrastructure

While quantum hardware continues to mature, financial institutions are finding innovative ways to prepare for the quantum future. Bookmap’s July 2024 report details how firms are developing hybrid approaches, combining classical and quantum-inspired algorithms to bridge the gap until full quantum systems become more stable and accessible.

Cost and Accessibility Solutions

Financial institutions are increasingly turning to quantum-as-a-service models through cloud platforms, democratizing access to this transformative technology. This approach allows organizations to begin implementing quantum solutions without massive upfront investments in hardware and specialized talent.

Regulatory Framework Development

As its capabilities expand, regulatory bodies are actively developing frameworks to ensure market integrity. Key focus areas include:

- Preventing market manipulation through quantum-powered strategies

- Ensuring fair access to quantum computing

- Establishing monitoring systems for quantum-enhanced trading activities

How will quantum trading change financial markets?

The financial sector stands at the threshold of a quantum revolution. As hardware stability improves and quantum-inspired algorithms mature, we’re witnessing the early stages of a fundamental transformation in how markets operate. Early adopters are already seeing benefits in:

- More sophisticated risk management systems

- Enhanced portfolio optimization capabilities

- Faster and more accurate market predictions

- Improved operational efficiency

Conclusion

Quantum trading isn’t just the future—it’s already beginning to reshape financial markets. While challenges remain in technology, accessibility, and regulation, the trajectory is clear. Financial institutions that embrace quantum capabilities today will be better positioned to thrive in tomorrow’s quantum-enabled financial landscape.

The question isn’t whether it will transform finance, but how quickly and comprehensively this transformation will occur. As we stand at this technological frontier, one thing is certain: the quantum revolution in trading has already begun.